Empowering The Next Generation Kids To Becoming Financially Literate

Financial literacy is the ability for you to make sound decisions with your money using a variety of financial tools (stock market, real estate, expenses, assets, etc.) By improving your financial literacy, you’re able to accumulate wealth and allow your money to work for you without physically working.

“Saving money in the bank” has been preached by many parents, teachers, and overall society. By only saving money, you’re letting inflation eat up your money every year by an average of 2%. By investing instead of saving, you’re letting your money compound to hedge against inflation. The stock market is one of the easiest ways to passively grow your money without much work.

Improving your Financial Literacy as early as possible is one of the best things you can do for your future self in-order to effectively utilize what is know as compound interest in the stock market.

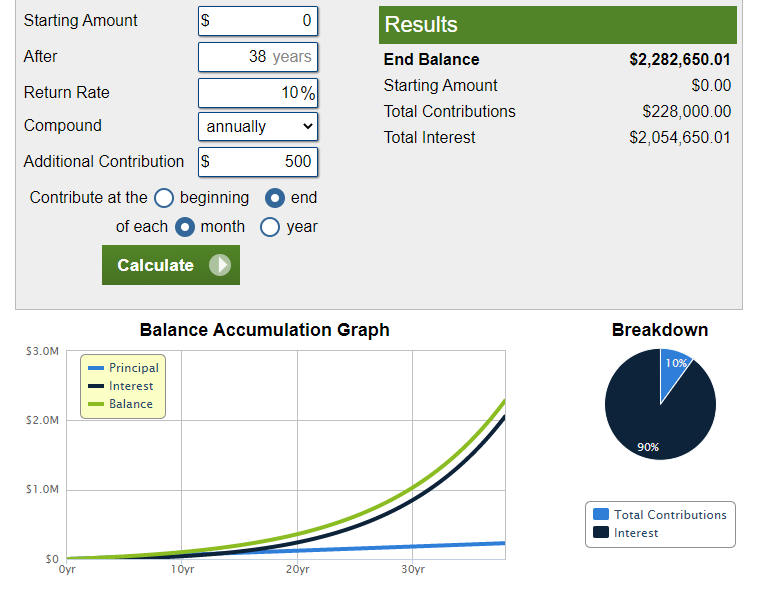

Shown here is a brief summary using diagrams of how to properly invest in the stock market with minimal risk. If you were to invest $500 per month at the age of 22, by the age of 60 you’ll have 2 million dollars absolutely tax free!

Assumed invested in a TFSA, does not account for inflation and bear markets.

When you get a job, live below your means by spending less than what you make per month so that you have the money to invest in the market, allowing your money to work for you.

Invest your monthly income in a low fee US index fund such as the S&P 500 which tracks the top 500 fundamentally sound companies in the US. This guarantees your share of the stock market without the risk of individual stock picking.

Life and the stock market can be unpredictable. Have cash set aside in a savings account so that it can be easily liquidable for emergency usage.

The short term of the stock market can be volatile and very unpredictable. By holding index funds for the long term, the fundamentals of the companies is almost guaranteed to make your investment richer.

An index fund is a collection of companies in 1 fund available for purchase in the stock market. By investing in an index fund like a S&P 500, you’re putting your money in the top 500 fundamentally sound companies located in the US. Index funds can be easily purchased online and can be easily liquidated into cash unlike real estate for example.

With individual company stocks, if they do poorly your stock also plummets. However in the case of the S&P 500, the fund has 499 other stocks with the potential to go up should one company do poorly. As quoted by billionaire investor Warren Buffet, “In my view, for most people, the best thing to do is to own the S&P 500 index fund”.

When you decide to sell your investments, you’ll need to pay something called capital gains tax. However, by improving your financial literacy and utilizing tax sheltered accounts, you can legally avoid paying some or all capital gains tax.

A tax free savings account is a type of account where you can purchase stocks, bonds, GICs, or mutual funds tax free. Therefore, anything you earn will be untaxed. However, there is a yearly limit on how much you can contribute to this account.

Instead of paying taxes now, you’re paying taxes later when you retire. This will dramatically reduce your tax bill because when you retire, your income will decrease. Stocks, bonds, GICs, or mutual funds can be bought using an RRSP.

Compound interest is best utilized the earlier you start, which is why it’s important to take advantage of such opportunity at a young age. If for whatever reason you lose your job, you’ll always have another source of income to help pay for your expenses.

As you can see time is your best friend when it comes to investing. The difference between investing in 20 years and 42 years is a couple million dollars.

Continue to improve your Financial Literacy at Deng Finance through our courses, absolutely free.

FREE

Which investment tool should you choose?

FREE

Where and how to invest as a teen, tax sheltered accounts, brokerage accounts, etc.

FREE

Is taking on debt worth it? What other routes are there?

The Content shown here at Deng Finance is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

© 2021 Deng Finance. All Rights Reserved